Is there a world food shortage coming next year?

How a world shortage of fertilizer could result in serious implications to crop yields in 2022.

One of the most important commodities in the world is quietly seeing rising prices as well as a slipping supply to suffice the massive world demand. That commodity is fertilizer.

As a result of soaring natural gas, urea, and ammonia prices, production of Nitrogen based fertilizers has become exceedingly costly for many of the world’s major fertilizer producers: leading to a worldwide shortage of fertilizer. The key product in crop production has been seeing prices quietly surge over the latter half of 2021, leading to providers cutting down production due to high costs, and many farmers being unable to source the product. The lack of global availability could result in devastation of worldwide crop yields for 2022 if supply continues to be constrained.

“I want to say this loud and clear right now, that we risk a very low crop in the next harvest… I’m afraid we’re going to have a food crisis. To produce a ton of ammonia last summer was $110… and now it’s $1,000. So it’s just incredible.” -Svein Tore Holsether, CEO & President of Yara International

Those were the words of Norwegian based Yara International’s CEO at the COP26 climate conference in Glasgow. Yara International is one of the largest producer of nitrogen fertilizer in the world. Such words echo a stark warning for the world populations regarding crop yields.

A poor crop yield in 2022 would immediately result in inflation in food prices, during a time where The Federal Reserve has continued to assure the world that current inflation “…[reflects] factors that are expected to be transitory.” Such price volatility in food that the global population surely needs could amplify inflationary price pressures into next year, and not only influence the populations of poorer countries, but also the United States, which is a major importer of farm nutrients and exporter of agricultural products.

What is fertilizer?

Now, I am sure someone reading this may quietly be thinking in their head, “So… what exactly does fertilizer do?”

Well, that’s a great question. Most know that fertilizers aid in delivering nutrients to plants, but how do they work and what do they consist of?

Here’s a quick primer:

Metaphorically, fertilizers to plants are like multivitamins to humans; they deliver the essential nutrients required by them. These nutrients can include nitrogen, potassium, and phosphorous. By enriching the soil around the plant, the water retention capacity and fertility of the soil can be increased to amplify crop growth.

These fertilizers can be organic, such as crop residues, manures, and slurries, or synthetic mineral based such as industrially produced fertilizers containing nitrogen, phosphorous, and potassium. Organic fertilizers vary in their consistency of nutrients, so larger scale farmers also use synthetic fertilizers to ensure consistency in nutrient delivery.

The production of synthetic mineral fertilizers requires an array of raw materials and chemicals. Below is a chart depicting the material used in production of ammonium nitrate, single superphosphate, and muriate of potash just to name a few fertilizer types:

Often times, nitrogen is the the nutrient that is limiting to further crop production, even though it is one of the most abundant elements on earth with the atmosphere containing nearly 78% nitrogen. Thus, synthetic nitrogen based fertilizers are the most produced fertilizers in the world.

Not only did the creation of synthetic nitrogen fertilizers allow for increased crop yields, but it also enabled livestock numbers to multiply greatly. The excess crops yielded from the fertilizer allowed farmers to use more of that to feed their livestock, specifically grain-fed animals, such as chicken [we will touch base on this point again later on].

Note that natural gas is the key ingredient in production of ammonia, which in turn is a key element in ammonium nitrate (as the name would imply) and urea ammonium nitrate. Price spikes of natural gas directly affect the price of ammonia, and thus the price of nitrogen based fertilizers. Natural gas prices have nearly doubled year over year, at a rate that many economists were not expecting.

World fertilizer usage

As of 2015, roughly half of the world population was supported with the production and usage of synthetic nitrogen fertilizers for food.

The world is immensely dependent on synthetic fertilizers for aiding crop production. Without an ample stockpile of fertilizers, many countries may see an extremely poor crop yield in 2022 after the growing season begins, generally denoted as the period between the last frost of the winter and the first frost of the fall.

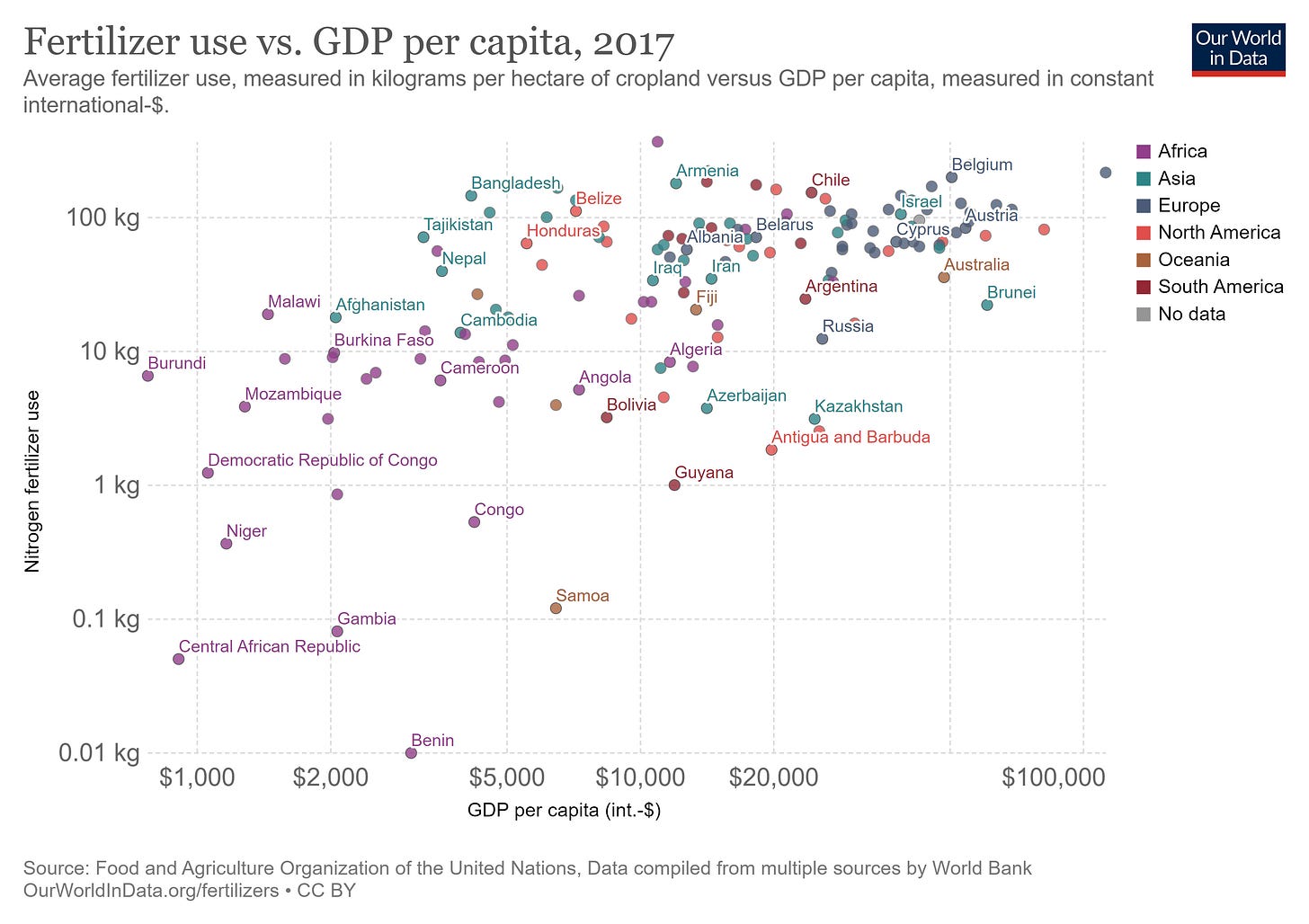

Many lower GDP per capita countries using large amounts of synthetic nitrogen fertilizer could potentially be devastated by large shortages or cost spikes in the product. Countries such as Burundi, Afghanistan, and Honduras, among many others using a high average of 10kg of fertilizer per hectare could be devastated by a lack of the product. Countries with larger populations also could be greatly affected, with the U.S., China, and Russia all using over 10kg per hectare on average as well.

China uses more phosphate based fertilizer than nitrogen based in their agriculture production, but is a massive player in phosphate production and trade, representing nearly 30% of the world trade for the product. China noted the shrinking world supply of fertilizers, and in early October implemented restrictions on phosphate exports until June 2022. This move alerted the world agricultural community the true potential of a large worldwide shortage of fertilizers. Russia, one of the main producers and exporters of nitrogen fertilizers, recently followed in China’s footsteps to impose limitations on exports; specifically to ensure domestic supplies and contain price inflation. The biggest customer’s for Russia’s nitrogen exports - the U.S. and Brazil.

The increased restrictions on international exports of fertilizers will only exacerbate price hikes and tighten available supply further. The United States have yet to directly issue this lack of supply and how the nation plans on aiding domestic food production into 2022.

What would a shortage imply?

There are numerous domestically produced food items that would be very sensitive to price and supply shocks to fertilizer.

Corn and wheat are two domestically grown crops that are very dependent on synthetic fertilizer for consistent crop yield. Lower yields would increase the prices of said crops, and have rippling effects on the food supply chain.

Due to corn’s dependency on fertilizer coupled with increased costs, many farmers are considering a shift away from corn to soybeans during the 2022-2023 farming season as a result. S&P Global Platts Analytics projects a 2 million acre shift away from corn to soybeans is possible in the upcoming year. The U.S. is the largest corn exporter in the world, exporting nearly $9.2 billion in 2020 as a result of increased Chinese demand for the crop. A shift away from corn production could result in a hit to the U.S. gross exports for 2022, and hiking prices for items produced with corn such as food products, biofuels, and animal feed- which takes up nearly 36% of U.S. corn. Ethanol is the largest usage of produced corn, and is key in the migration away from fossil fuels to cleaner energy alternatives.

Remember the mention of chicken feed earlier?

Price increases in grains such as wheat and corn have and will continue to negatively influence the poultry industry. Feeding chickens is quickly becoming one of the most costly components of poultry farming, directly resulting in price increases for poultry and eggs domestically.

These price increases most likely will only get worse into 2022 as the fertilizer shortage is further felt worldwide. Beef, pork, and poultry have all increased at a much faster rate than other food items, accounting for as much as half of price inflation at grocery stores. These price increases will only further hurt the average U.S. consumer who wish to feed their family.

And with U.S. poultry exports currently on track for another record year, price increases could influence other countries who import chicken and eggs from the U.S. such as China, Mexico, and Cuba.

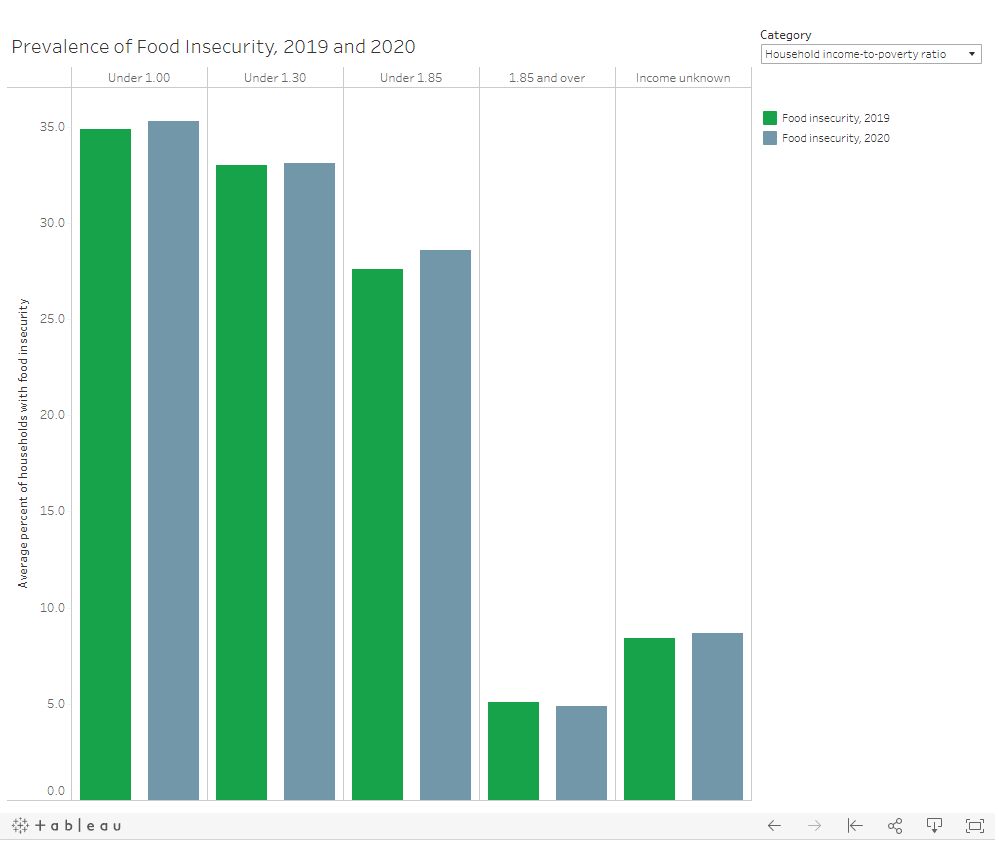

The result of a shortage is a domino effect of food supply chain items increasing in price, and potentially pricing out many of those struggling against food insecurity. Nearly 38 million Americans in 2020 lived in households that struggled against food insecurity, with those affected being predominantly in household income-to-poverty ratios of under 1.00.

Worldwide, 2020 was a year that marked a major surge in world hunger- with nearly 1 out of every 10 people on earth undernourished. Undernourished is defined as not having enough to eat for a normal and healthy life for a period of at least one year. Undernourishment was most prevalent in low-income nations such as Yemen, the Democratic Republic of Congo, and Burundi. Countries which as previously mentioned, as very dependent on fertilizer for crop yields.

Bold and fast actions need to be taken by world leaders regarding the fertilizer supply chain in order to ensure we as a global population do not have a food shortage in 2022.

So what’s next?

On their most recent earnings call, CF Industries, a large American manufacturer of ammonia and fertilizers, reiterated the comments made by their Norwegian competitor reiterating that the reduction in global crop yields next year is a very real risk.

When asked with what could tame input prices such as nitrogen fertilizer, John Beghin, Agricultural Economist at the University of Nebraska, had this to say:

“Look at the lack of integration, for instance, for potassium-based fertilizer… I mean, we have prices in the U.S. now almost $700 per metric ton and the same in Brazil, yet the Vancouver price is around $225. So yes, obviously there are supply disruptions that could be resolved and transportation issues, so those could be resolved in that sense.”

According to Beghin, there could be some optimization as to how the U.S. deals with its supply and transportation issues. However the fact still stands although fertilizer price may not increase at a rate as high as it has recently, it will continue to steady at increased prices:

“If you look at the outlook for fertilizer, the World Bank says that 2022, we won't see price increases, but price will be steady at where they are… So, that's the outlook from the World Bank on fertilizer prices. That's not the great news, but it doesn’t say prices are increasing. But the problems won't be resolved instantly.”

It is up to the world’s largest economies to support increased capacity for fertilizer production and transportation, as well as aid to farmers that could potentially feel the burden of increased costs in 2022. As much as The Federal Reserve has enjoyed dancing with the concept of transitory inflation in their messages to market participants, the lax attitude towards the domino effect of future inflationary shocks caused many to be taken off guard by the volatility in commodity prices.

This price shock will only continue to effect global economies into 2022, this time with the food that we eat instead of the fuel that we burn.

If you enjoyed this post, subscribe to Leverd for more unique and uncommon economic, statistical, and market insights!

—————————————————————————————————————

Nothing in this post shall be constituted as financial advice, I am not a financial advisor. All writings are opinions and not financial advice.